21 Ways to Reduce the Impact of BREXIT on your Business & Personal Finances…

Whatever your political persuasion, wherever you placed your cross on the ballot paper on the 23 June 2016, events are now unfolding that will change the economic landscape of the UK for generations to come. As your trusted advisers and award winning accountants, we have a duty to help all clients and we will be proactive in supporting you all during these times. We start with this article.

[show_more more=”MORE” less=”LESS”]

Contact us

In this article, we will cover:

- What happens next

- What is Article 50

- Uncertainty

- How your business will be affected

- How your personal finances will be affected

- Your ten point business and personal finance check list

So what exactly happened on 23 June? Are we still in the EU? Aside from the political upheavals, what are the practical problems that small business owners and tax payers will be facing as a direct result of the Brexit vote?

In this short report we have attempted to de-mystify the steps our government will need to take in order to carry out the outcome of the referendum; that we leave the European Union.

More importantly, it sets out the steps that business owners and individuals can take now to minimize any downside risks posed by the withdrawal.

Whilst we wait for the political process to unwind, we should take time out for thoughtful consideration of the effects these changes may have on our businesses and personal finances. Hopefully, this article will help.

At the end of the article is a 21 point check lists illustrating the practical strategies that could be employed now in order to see you and your business through the change processes that we face. The old adage “be prepared” is still valid:

“By failing to prepare, you are preparing to fail.”

-Benjamin Franklin

Whilst it always pays to be positive, it’s also important to be realistic and start putting together a plan B.

[thrive_leads id=’1856′]

What happens next?

72% of those qualified to vote actually voted. Of those who voted, 52% voted to leave the EU and 48% to remain. As the result was decided by a simple majority of those who voted, the UK electorate has a confirmed that they want to leave the EU.

Although this result is a strong incentive for government to start the process of disengagement from Europe, it does not mean that from 6am, 24th June 2016, we are no longer paying members of the EU. Our membership and responsibilities will continue until the legal process is concluded by our elected representatives.

So what happens next?

In his resignation speech, David Cameron said:

“A negotiation with the European Union will need to begin under a new prime minister and I think it’s right that this new prime minister takes the decision about when to trigger Article 50 and start the formal and legal process of leaving the EU.”

In other words, our membership will continue with no change until David Cameron’s replacement is found and he or she formally applies to the EU under Article 50 to leave. This will likely be in the autumn, shortly before the Conservative’s Annual Conference. It should be noted that the European Commission has been quick to respond, they will be pressing for a faster disengagement to minimize uncertainty.

What is Article 50? The next section explains…

What happens next?

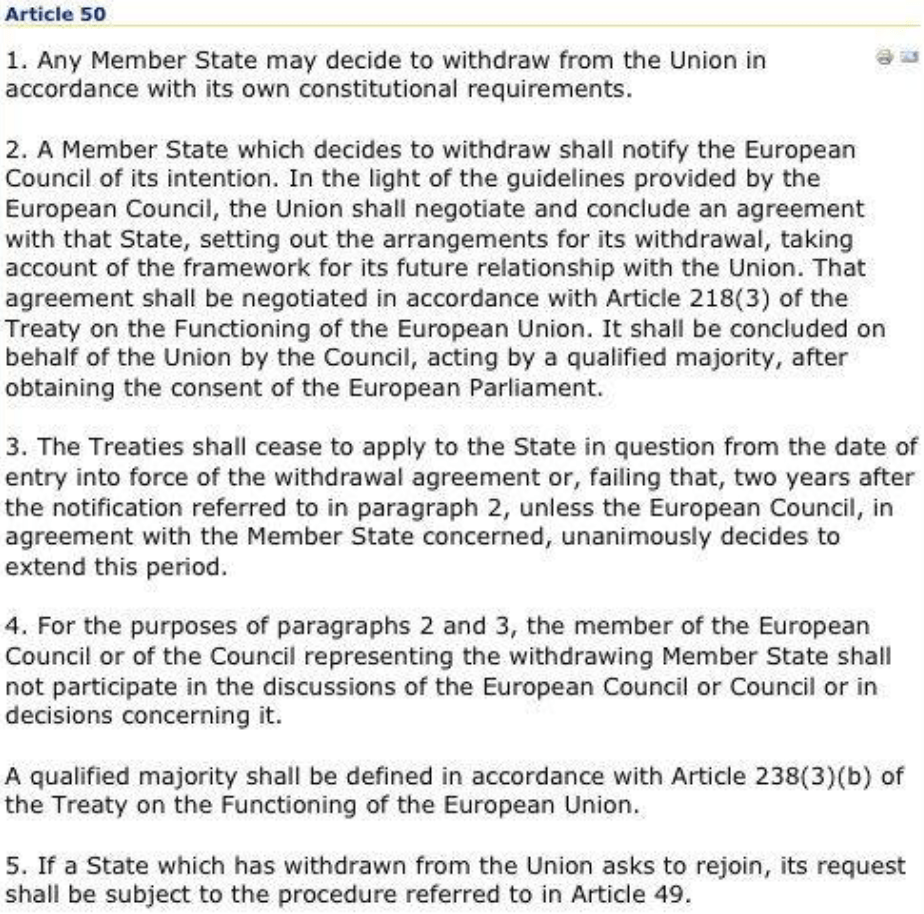

Article 50 is reproduced below:

Basically, this sets out the legal framework for the UK’s disengagement from Europe. Until this Article is triggered, and it can only be triggered by a member state, the formal process of negotiation to leave the EU cannot start. Once started, it needs to be concluded within 2 years unless both parties agree to an extension of this deadline.

If the new leader/prime minister is in post for the 1 October 2016 (2 days before the Conservative’s annual conference begins), and if the formal application to leave is lodged in accordance with Article 50 at the same time, then we should expect to be disentangled from our European partners on or before October 2018.

If we are unlikely to commence legal proceedings for 3 months, why are the financial markets in such turmoil right now? The next section looks at this conundrum.

Uncertainty?

The standing of the UK in the financial markets is based on the opinion that the world’s currency, commodity and stock market traders have regarding the financial worth and wealth producing potential of the UK.

In order to reach a conclusion on these indicators, the markets crave certainty. They like the numbers to make sense, to stack up. Without certainty, the value of our companies and the price that our currency will be worth, compared to other currencies, becomes a guessing game.

The decision on 23 June 2016, to leave the EU, has removed some of the certainty regarding our ability to balance our books and trade effectively in the world economy. Until we are ex-members of the EU, and until we have renegotiated new trade agreements with the EU and the rest of the major economies, this “market certainty” is likely to be an issue that will continue to unsettle the markets.

The day following the referendum, stock markets tumbled and then recovered somewhat, sterling’s exchange rate with the major currencies dropped, and then recovered somewhat. As such, there is no sign of an impending collapse in sterling or any long term downward trend in the global stock markets. Only time will tell if the short-term corrections will be recovered or sustained. Thus far, it’s steady as you go.

In some respects, the delay in appointing a new prime minister and starting the formal leaving process, will exacerbate uncertainty. The European Commission will be impatient to resolve the situation as the UK’s decision to leave affects the entire European project. It may also encourage other disaffected member states to lobby for a UK-type referendum.

However, to protect your interests, we have focused in this booklet on the ways in which these market reactions may affect your personal or business affairs. Our conclusions are set out of the following pages.

[thrive_leads id=’1856′]

How will my business be affected?

The factors that may affect businesses, especially smaller businesses in the UK, in the coming months are bullet-pointed below. Don’t forget that these are generalisations. Some may apply to your circumstances and some may not.

If the sterling exchange rate settles at a lower level the cost of imported goods will rise and our exporters may benefit as their goods and services will be priced lower in overseas buyer’s markets.

If the rising cost of imports triggers inflation the Bank of England may have to step in and increase interest rates. This will increase the cost of borrowing; business profits will suffer as will cash flow.

An alternative scenario is also possible. The Bank of England may reduce interest rates to encourage investment and lower the cost of borrowing for UK businesses and home owners.

Firms that trade in the property sector will need to keep a weather eye on demand as buyers may be discouraged by the overall uncertainty about the longer term outlook for interest rates. As a consequence, we may see the property market flat-line or prices fall.

Uncertainty may encourage banks and other lenders to be more cautious when considering loans. Cash flow management should possibly shift towards the top of to-do lists, just in case there is downward pressure if credit does tighten up.

Businesses and non-profit making enterprises that rely on EU funding should contact their funding agencies as soon as possible. Be prepared. Start looking for alternative funding now. Support for farmers and other key groups may be replaced by UK government grants.

Businesses that trade with the rest of the EU will need to re-examine their sales and marketing strategy for the future. If and when the final EU curtain falls they will likely find their exports subject to tariffs. Time to start looking for alternative export markets or ways to increase penetration in the home market.

Firms that are part of the supply chain for multinational concerns will need to be vigilant. Car manufactures, pharmaceutical companies, international banks and others, that have based their operations in the UK as a spring board to the EU markets, could possibly reconsider their options.

If consumer demand in the UK hardens, the ability to pass on increased costs may become a problem for smaller businesses already coping with smaller margins and shrinking demand for their products and services.

Finally, we may have face tax increases as the UK struggles to balance its books and repay debt. Should this happen, please refer to my last report on dividends tax planning. There are still plenty of ways to reduce tax without turning to aggressive tax schemes.

Businesses will need to be on their guard. Businesses and individuals should be watchful and stay positive. There are small business owners who would say that they were held back by EU regulation and will now be free to explore alternative markets. There are others that will be concerned by any loss of access to European markets. In any event, it pays to trim your sails if a storm is forecast, even if it blows over.

How will my personal finances be affected?

For the last 40 years, our financial institutions have been built inside an integrated European Union. As a nation, we will need to act quickly to re-establish this framework outside the EU. The following points flag up some the issues we should keep an eye on:

As the banks adjust to the situation, credit may tighten up: it may become more difficult to obtain loans or mortgages.

In the short-term interest rates may fall, longer term they may rise. The latter will have an impact on debt repayment.

As the cost of imported goods will almost certainly rise, due to exchange fluctuations and as tariffs are imposed, the cost of the weekly shop will increase.

Adverse movements in the sterling exchange rate will possibly increase the cost of imported oil and gas. If so, monthly utility bills may increase, as will the cost of filling up our cars. Time to look at hybrids or use public transport.

Without increased government subsidy, rail, air and road transport costs may rise adding further inflationary pressures and increases in domestic expenditures.

Employers, suffering from the same cost increases, will be reviewing recruitment and the cost of labour. We may see rises in unemployment and downward pressure on future pay increases.

If house prices do fall in the medium term, buyers should be cautious and ensure that their intended purchase is based on a realistic assessment of current market value. Negative equity – where loans to purchase are higher than market value – will become an unwelcome consequence for those who purchase in haste in a falling market.

If interest rates do fall, returns for savers could all but disappear.

This may be a good time to check out your credit rating. You should position yourself at the top end of the scale if you want to meet your family’s needs.

Finally, austerity cuts may not be enough to balance the UK’s budget and pay off our national debts so we should be wary, future tax increases may be on the horizon.

Re-engaging with the rest of the world and renegotiating our exit with the EU is going to take some time and associated uncertainties will likely continue until they are resolved.

Time for caution and tightening of belts.

Want to find out the best guidelines for avoiding the pitfalls of BREXIT?

Download our free 21-point checklists for your personal or business finances today…

[/show_more]

[thrive_leads id=’1856′]